Running an accounting practice requires precision, organization, and time management. But with growing client demands and complex financial systems, inefficiency can quickly become a challenge. Streamlining your workflows and improving efficiency can help you deliver better results while freeing up time for more important tasks. That’s where Accru comes in- by providing tools designed to simplify your billing and payment processes. Here are the top three ways to increase efficiency in your accounting practice, and how Accru can help you achieve them.

1. Automate Repetitive Tasks

One of the quickest ways to boost efficiency is by automating repetitive, time-consuming tasks. Invoicing, payment reminders, and follow-ups can take hours of manual work each month. By automating these tasks, you can focus on higher-value activities, such as providing strategic advice to your clients.

Accru allows you to automate your invoicing process from start to finish. With features like recurring invoices, automated payment reminders, and scheduled follow-ups, you can ensure that your clients stay on track without having to manually intervene. Automation reduces the risk of errors, ensures timely payments, and saves you valuable time that can be better spent on growing your business.

2. Simplify Your Billing Process

A complicated billing system can slow down your workflow and frustrate clients. Efficient billing practices not only save you time but also improve client satisfaction. The more straightforward your billing process, the easier it is for clients to pay you on time.

Accru simplifies billing by offering customizable invoices that are easy to create and send. You can quickly generate professional-looking invoices that are tailored to each client’s specific needs, ensuring clarity and transparency. Accru’s platform allows clients to access their invoices in real time, track payment history, and make payments directly, reducing the chances of late payments or billing disputes. By eliminating unnecessary steps, Accru helps you streamline your operations and create a frictionless experience for both you and your clients.

3. Use Real-Time Tracking and Reporting

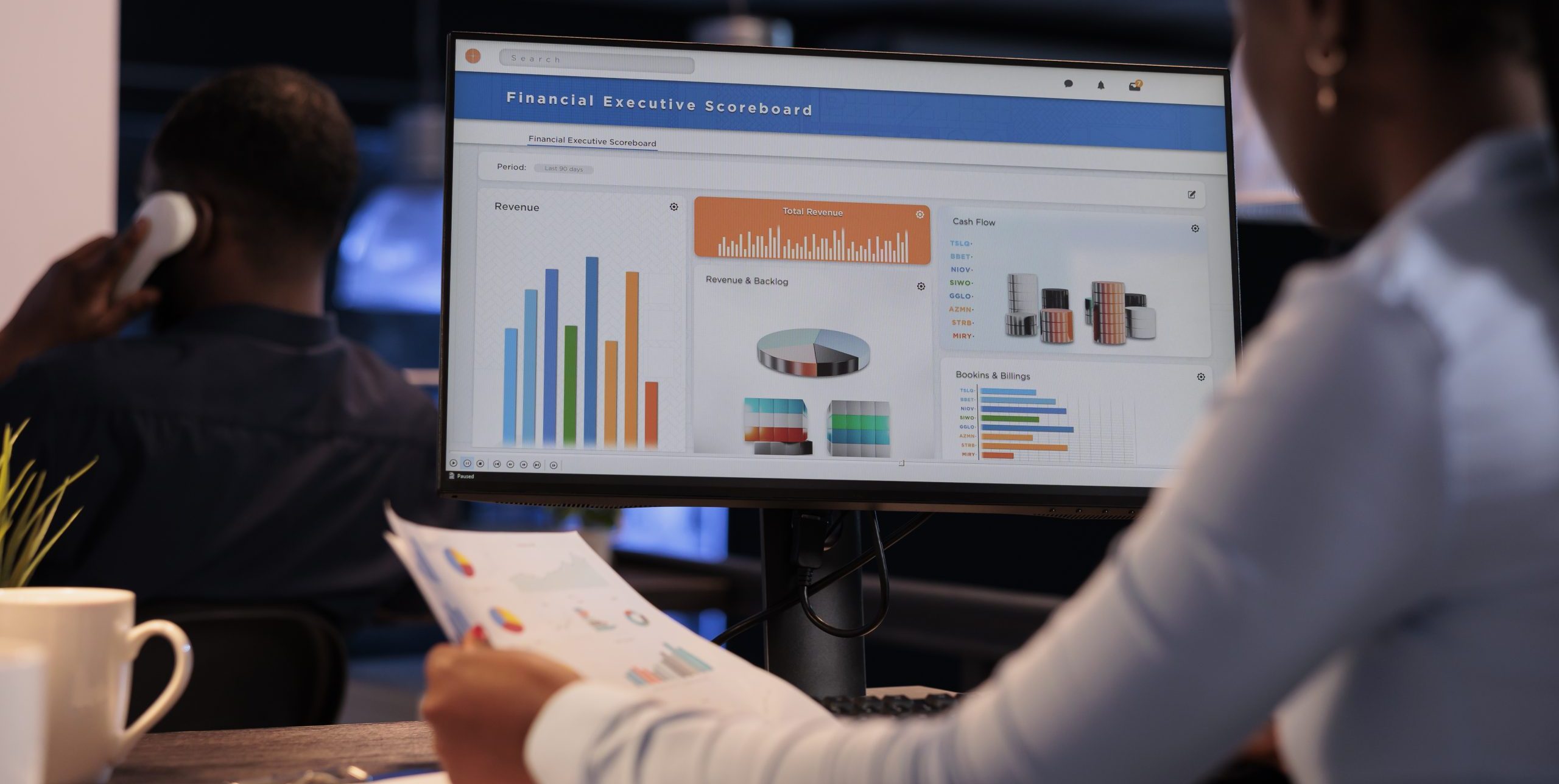

Another critical component of an efficient accounting practice is having the ability to track payments, expenses, and cash flow in real time. Without this capability, you may end up wasting hours manually reconciling records or chasing down payments. Accru’s real-time tracking and reporting features ensure that you always have an up-to-date view of your finances, making reconciliation and tracking more efficient.

With Accru, you can monitor which invoices have been paid, which are outstanding, and what payments are pending. This level of visibility allows you to stay organized, catch any discrepancies early, and avoid delays in your cash flow. Plus, real-time reporting helps you analyze trends and make informed decisions to improve your overall business performance.

Increasing efficiency in your accounting practice doesn’t have to be difficult. By automating repetitive tasks, simplifying billing, and using real-time tracking and reporting, you can streamline your operations, reduce manual errors, and focus on providing more value to your clients. Accru is designed to help you do just that, by offering the tools and features you need to enhance your practice’s efficiency.

Ready to transform the way you run your accounting practice? Try Accru today and discover how easy it can be to boost efficiency and get paid on time.

You may also like:

5 Common Payment Challenges For Businesses

How to Choose The Right Invoicing Software

Follow us on Instagram!